Unlocking In-Depth Analytics for Insurance and Financial Services Websites with Insightech

Learn how Insightech overcomes GA4's limitations with raw data analytics and session replays, offering clear visibility into user interactions.

In the insurance and financial services sectors, understanding customer behaviour on your website is crucial. However, companies often face a significant challenge: a lack of clear visibility into user interactions, especially in critical areas like quote and buy forms or while exploring product pages and service offerings. Traditional tools like GA4 come with their limitations, such as data sampling and complex data management in BigQuery. Here's where Insightech steps in, offering a robust solution with its powerful, raw data analytics capabilities.

A Common Challenge: Gaining Clear Visibility

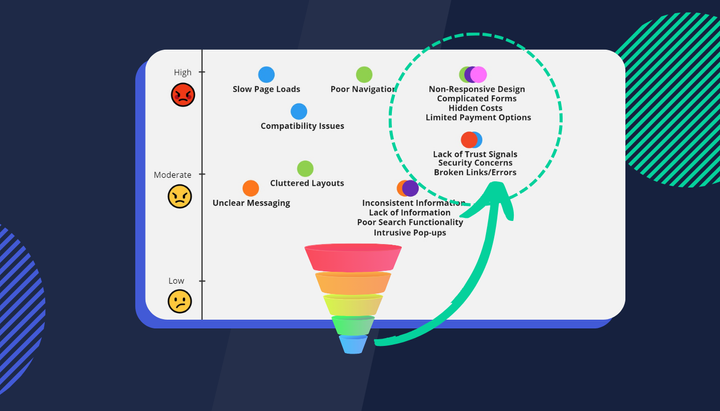

For insurance and financial services websites, every user interaction is a potential insight into customer needs and preferences. However, gaining a comprehensive understanding of these interactions is often hindered by limited data visibility. This is particularly true for intricate processes like completing quote forms or navigating through various service offerings. Traditional analytics tools might give you numbers, but they often fail to provide the complete story.

The Limitations of Traditional Analytics Tools

Google Analytics, for instance, is a common tool used by many businesses in the insurance and financial services space. Everyone knows it and has grown comfortable using it to produce reports for a long time now. However, GA4 does have drawbacks today:

- Sampled Data: GA4 often relies on sampled data for reporting, which can lead to a lack of precision in understanding user behaviour.

- Complexity in BigQuery: Extracting and manipulating data in BigQuery can be a daunting task, requiring significant technical expertise and time.

- Aggregated Data: High-level numbers about clicks, sessions, page depth, and average time on page are all useful but they can't for example tell you why users drop out of your Quote and Buy funnel.

These limitations mean that businesses might not be getting the full picture of how users interact with their sites, leading to less informed decisions.

The Power of Session Replays

Session replays are a game-changer in this context. They allow businesses to see exactly how users interact with their website, providing a video-like playback of user sessions. This level of detail offers invaluable context that raw numbers alone cannot provide, helping businesses understand the 'why' behind user behaviours.

Insightech addresses these challenges head-on with its powerful analytics capabilities which customers get immediate access to on day one (sooner if you're on a trial account):

- Rich, Raw Data: Unlike GA4, Insightech provides unsampled, raw data, giving you a complete and accurate picture of user behaviour.

- User-Friendly Interface: Insightech’s UI is designed for ease of use, making data analysis accessible even for those with limited technical skills.

- Efficient Implementation: With just a single line of tracking code, Insightech is easy to implement and doesn’t burden your site’s resources.

- Real-Time Insights: Get immediate feedback on user interactions, allowing for swift action and decision-making.

For insurance and financial services companies looking to deepen their understanding of customer behaviour on their websites, Insightech offers a powerful, user-friendly, and efficient solution. By overcoming the limitations of tools like GA4 and providing detailed insights through session replays and raw data analytics, Insightech empowers businesses to make more informed decisions, enhance user experience, and ultimately drive higher conversion rates.

If you have questions you can ask them here and our team will get back to you.