Understanding Data Sampling in GA4 and Its Impact on Digital Product Owners in Insurance and Financial Services

Explore how GA4's data sampling impacts digital product reporting in insurance and financial services.

While GA4 offers a range of powerful analytics capabilities, its reliance on data sampling can pose significant challenges for digital product owners in the insurance and financial services industries.

Accurate and detailed data is crucial for making informed decisions. Here's how data sampling in GA4 can impact your reporting:

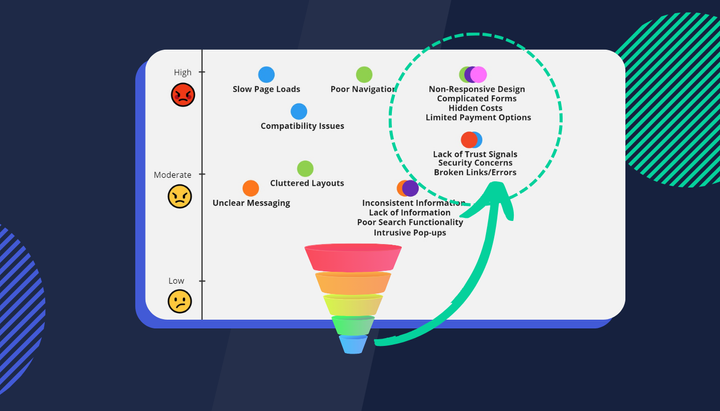

- Reduced Precision: Sampling can lead to less precise data, which might not fully represent the diverse and specific user behaviours on insurance and financial services websites.

- Missed Insights: Important but less frequent user interactions, such as specific issues in form completions or unique navigation paths, might be overlooked in a sampled dataset.

- Challenges in Trend Analysis: Identifying and analyzing trends over time can be difficult with sampled data, as inconsistencies in the sampled subset can lead to misleading conclusions.

- Implications for User Experience Optimization: Without complete data, optimizing the user experience for complex financial products and services becomes a challenge, as key pain points or user preferences might not be accurately identified.

Data can be pulled out of Big Query if you have the resources and internal skills but often teams lack the time and capability to do this regularly. One way to solve this challenge is with a product such as Insightech - a behavioural insights data platform, designed to provide in-depth, actionable analytics with remarkable ease. The user interface (UI) simplifies the process of compiling complex reports, all enabled by a single line of tracking code. This approach offers several key benefits for digital product owners in the insurance and financial services sectors.

Key Benefits of Insightech vs. GA4

- Easy Implementation and Low Maintenance: The single line of tracking code makes Insightech incredibly easy to implement and maintain. This simplicity is a significant advantage, especially for websites with complex structures and multiple user paths, common in the insurance and financial services industries.

- Access to Powerful, Raw Behavioral Data: Unlike GA4, which often relies on sampled data, Insightech provides raw, unsampled behavioural data. This level of detail is crucial for understanding the specific ways users interact with insurance and financial products and services online.

- User-Friendly Interface for Complex Reporting: Insightech's UI is designed to be intuitive, making it easy for teams to generate in-depth reports. This user-friendly approach means that even team members with limited technical expertise can dive into data analytics, democratising data access and interpretation within the business.

- Comparative Analysis Across Audience Segments: Insightech enables digital product owners to easily compare audience segments over time. This feature is particularly valuable in understanding how different user groups interact with various aspects of a website, leading to more targeted and effective optimisations.

- Direct Access to Session Replay Recordings: Perhaps one of the most powerful features of Insightech is its ability to link data insights directly to session replay recordings. This capability provides context to the raw data, allowing teams to observe firsthand how users navigate, where they encounter issues, and what elements drive engagement or lead to drop-offs.

For digital product owners in the insurance and financial services industries, Insightech offers a comprehensive solution to the limitations of traditional analytics tools like GA4 or Adobe Analytics. Its combination of easy implementation, powerful raw data, user-friendly reporting, comparative analysis, and direct access to session replays makes it an invaluable tool for gaining deep insights into user behaviour.

These insights are crucial for optimising user experience, improving product offerings and ultimately driving higher completion rates.

If you have questions you can ask them here and our team will get back to you.